탄산 리튬의 가격의 반등이 예상된다는 기사를 접해서 가져와봤습니다.

출처: Lithium carbonate prices expected to rally by end-Sep | Mysteel

Lithium carbonate prices expected to rally by end-Sep | Mysteel

Customer Service: globalsales@mysteel.com

www.mysteel.net

China's lithium carbonate prices are expected to fall in the near term since the demand has not yet fully picked up based on the orders placed, but will probably rally by the end of September considering the low inventory among both upstream and downstream players as well as anticipated demand recovery.

중국의 탄산 리튬 가격이 조만간 떨어질 것으로 전망되었지만, 9월을 끝으로 업스트림과 다운스트림의 예상 수요가 증가할 것으로 전망된다.

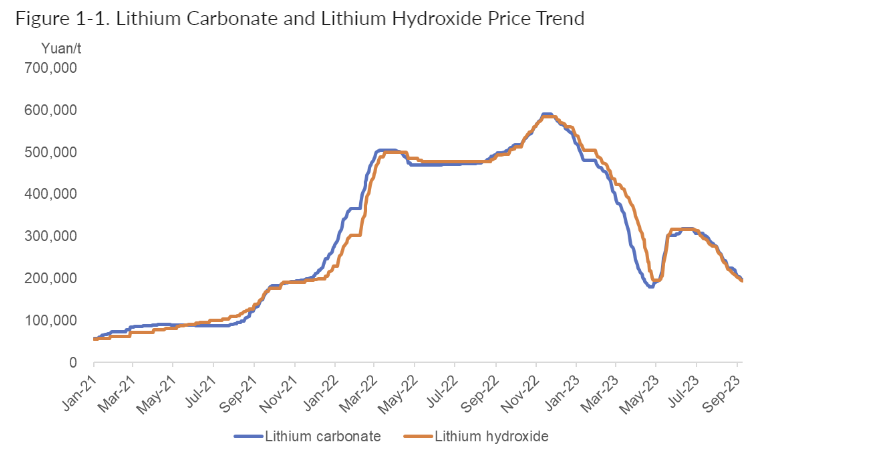

According to Mysteel observation, the prices of battery grade lithium carbonate and lithium hydroxide dropped 2.95% and 3.96% respectively week on week at Yuan 197,500/t and Yuan 194,000/t as of September 8.

Mysteel에 따르면, 탄산리튬과 수산화리튬 가격이 각각 전주대비 2.95% 3.96%로 떨어졌다.

With smelters gradually disclosing their production scheduling for September, it is increasingly clear that the prices of lithium carbonate are primarily subject to the demand side in the month. Should the end-market demand recover by the end of September, the battery factories' stockpiling activities will support lithium carbonate prices to a certain extent.

제련소에서 9월 생산 일정을 공개함과 동시에, 탄산리튬의 가격은 점점 수요 측면으로 인해 결정된다는 것이 분명해지고 있다.

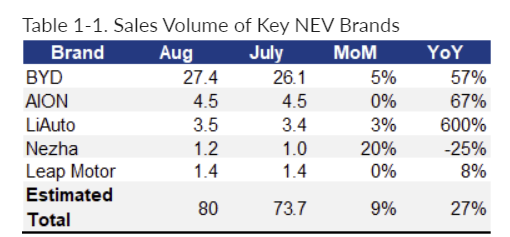

Mysteel estimates that the sales volume of new energy vehicles (NEVs) should have reached 800,000 units in August, up 9.2% from July, based on the disclosed sales performance of large brands. BYD sold 274,000 vehicles in August, rising 5% month or month. The sales volume of GAC AION and LiAuto stood at 45,000 and 35,00 vehicles respectively, an increase of 0% and 3% MoM respectively.

Mysteel은 8월 NEVs의 판매는 7월대비 9.2%성장한 80만개일것이고, 대형사의 판매가 기반이 된 덕이다.

BYD는 274,000대 판매했고, 전월대비 5%상승했다.

Generally, China's NEV sector is experiencing a demand recovery course at present, and the demand is believed to substantially rebound by the last week of September promoted by falling deposit interest rates as well as NEV replacement subsidies.

일반적으로 중국의 NEV 섹터는 현재 회복세를 겪고 있으며, 수요는 9월 마지막 주부터 튀어오를 전망이다.

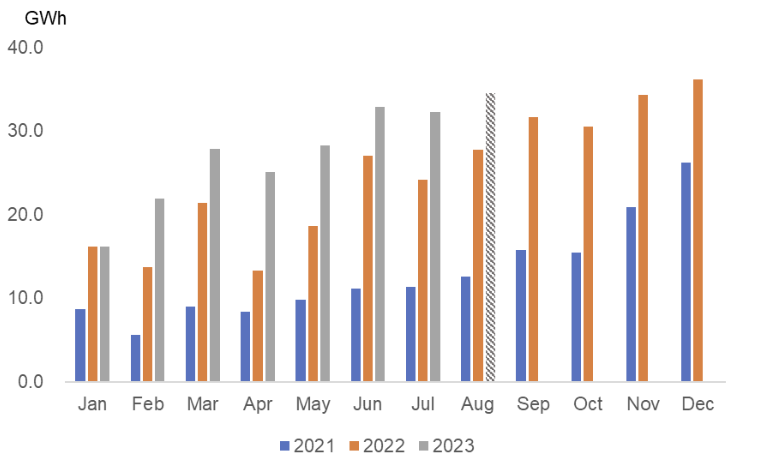

Regarding the battery installation, the installed capacity of BYD power battery and energy storage battery totaled 13.92 GWh in August, up 12.2% from July. The combined lithium-ion battery installed capacity is estimated at 36.8 GWh in August, including 34.5 GWh of power battery, an increase of 8% from 32 GWh in July.

배터리 설치와 관련하여, BYD의 설치양은 13.92기가와트시로 12% 증가했다.

리튬-이온 배터리는 36.8기가 와트시로 8월대비 8%증가했다.

On the raw material side, the production of LFP cathode materials dropped 8.1% MoM at 150,600 tonnes in August, and is estimated to rise 8.81% on a monthly basis at 163,900 t in September, according to Mysteel survey. Ternary cathode materials' production stood at 55,300 t in August, rising 4.34% from July; and the production is projected at 53,600 t in September, down 3.05% MoM.

원자재딴에서, LFP 배터리 재료는 8월 8.1% 감소했고 9월 8.81% 증가할 것으로 보인다.

삼원계 배터리는 8월 55,300톤으로 7월 대비 4.34% 증가했고 9월에는 3.05% 감소한 53,600톤으로 전망된다.

In summary, lithium carbonate prices are expected to fall further in the near term on relatively poor demand. But the low lithium carbonate inventory held by both lithium salt smelters and battery factories will shore up lithium carbonate prices should the end-market demand revive as expected by the end of September.

It is worth mentioning that the high finished battery inventory of battery factories is a potential bear for lithium carbonate prices.

Mysteel projects that lithium carbonate prices will move between Yuan 180,000-210,000/t through September.

요약하면, 탄산리튬의 가격은 수요의 부족으로 하락할 전망이다. 하지만 탄산리튬 재고 부족으로 인해 수요가 도와준다면 다시 상승할 가능성이 있다.

최근 내수 중심전략을 갖고가는 BYD의 판매량이 엄청나게 증가하고 있는 것으로 알고있는데, 리튬을 계속 팔로업하면서 국내 영향까지도 공부해봐야겠다.

'매크로분석' 카테고리의 다른 글

| 중국 부동산 전망 (40) | 2023.09.09 |

|---|---|

| 잭슨홀 미팅 및 미국물가지표, 일본완화정책, 중국의 경기부양책 (28) | 2023.09.03 |

| [미국경제리뷰] 서브프라임 모기지 사태 (18) | 2023.08.28 |

| [미국경제리뷰] 달러가 패권을 가질 수 있었던 이유 (18) | 2023.08.25 |

| [중국경제전망] 리오프닝VS 부동산발 경기침체 (24) | 2023.08.20 |